Xinyi Glass Announces 2023 Annual Results

Both Revenue and Net Profit Climbed

Continues to Strengthen its International Development Strategy

Seized Market Recovery Opportunities

* * *

Dividend Payout Ratio Remains Stable

Full-year Dividend at 63.0 HK Cents per Share

Summary

(Hong Kong, 29 February 2024) ― Xinyi Glass Holdings Limited (“Xinyi Glass” or the “Group”) (stock code :00868), a leading integrated automobile glass, energy-saving architectural glass and high-quality float glass manufacturer, today announced its annual results for the year ended 31 December 2023 (the “Year Under Review”).

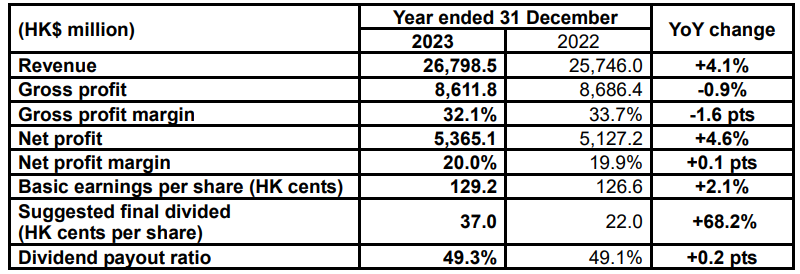

Float glass prices, which rose steadily in the second half of 2023, had driven growth in sales revenue of the Group. During the Year Under Review, the Group managed steady performance overall, with revenue up by 4.1% y-o-y to HK$26,798.5 million (2022: HK$25,746.0 million). Gross profit was HK$8,611.8 million (2022: HK$8,686.4 million), a slight decrease of 0.9% against last year, and gross profit margin was 32.1% (2022: 33.7%). The Group’s annual net profit increased by 4.6% y-o-y to HK$5,365.1 million (2022: HK$5,127.2 million), with net profit margin at 20.0% (2022: 19.9%). Basic earnings per share were HK129.2 cents (2022: HK126.6 cents).

The Group’s financial status remains strong. As at 31 December 2023, it had cash on hand of HK$3,426.6 million (31 December 2022: HK$ 8,167.3 million). Its bank loans reduced by HK$5,342.0 million and net debt gearing ratio fell to 13.3%. The Board of Directors has recommended payment of a final dividend of HK37.0 cents per share and, together with an interim dividend of HK26.0 cents already paid, total dividend for the year is 63.0HK cents, representing a dividend payout ratio of 49.3%.

Dr LEE Yin Yee (S.B.S), Chairman of Xinyi Glass, said, “2023 was a year full of challenges and changes – the costs of raw materials continued to rise in the first half (“1H”) of the year and the glass industry entered into a period of consolidation. Situations began to stabilize in the second half (“2H”) of the year with the positive effects of the state supporting the real estate sector and assured delivery of properties becoming apparent. For the Group, boasting a solid business foundation and such core strengths as high-quality products and strong presence in China and Overseas, it has leadership edges over smaller players in the industry and is able to control greater extent impacts of external risks. Xinyi Glass will closely follow national policies, seize opportunities and keep improving its business layout, so as to maintain its leadership and competitive advantages."

Business Review

Float glass

During the Year Under Review, with prices of float glass continued to rise in the 2H of 2023 and sales volume rose steadily, so the business went back on the uptrend. Revenue from float glass increased by 5.3% year-on-year to HK$17,467.9 million, accounting for 65.2% of the Group’s total revenue. Gross profit of the segment totaled at HK$4,628.6 million, a 4.7% increase relative to the previous same period, with gross profit margin at 26.5%. With the country introducing a series of favorable policies for the real estate industry and the increased property completion volume, sending it back to the steady development path, demand for float glass is expected to boost this year. The Group will continue to expand its portfolio of high value-added and differentiated products to maintain its competitiveness. It remains cautiously optimistic about the long-term development of the segment.

Automobile glass

Although overseas demand for automobile glass has been recovering, with the global economy in the slump and affected by high inflation and currency volatility, revenue from the segment declined by 1.6% year-on-year to HK$5,981.0 million, gross profit dropped by 6.3% to HK$2,864.9 million, and gross profit margin was 47.9%. The Group exports automobile glass mainly to the after-sale market. Downstream customers are dispersed with rigid demand, the Group has relatively strong bargaining power. In addition, new automobile glass production lines in Malaysia started operation, and a new automobile glass production line to be built in Gresik, Java, Indonesia, matching the long-term growth of its related businesses, the Group expects the burden from overseas import tariffs will significantly ease.

Architectural glass

With real estate policies further relaxed and a good number of measures in place supportive of real estate projects seeking financing, the real estate market has seen healthy development. Driven by that favorable factor, the performance of the Group's architectural glass business was robust, bringing in revenue of HK$ 3,349.6 million, 8.9% more year-onyear, and gross profit of HK$1,118.3 million, the drop narrowed to 7.3%, with gross profit margin at 33.4%. As the production capability of larger and multi-layer structured architectural glass is increasing, market demand has doubled and the proportion of high-end products in demand has increased, performance of the segment is expected to improve gradually.

Market Analysis

During the year under review, the Greater China region continued to be the Group’s main market. Revenue from the region recorded satisfactory growth, up by 10.6% year-on-year, to HK$19,427.7 million, accounting for 72.5% of the Group’s total revenue. As for the overseas markets, the overall revenue from North America, Europe and other regions was HK$7,370.8 million, making up 27.5% of the Group total.

Prospects

The price of soda ash is expected to drop gradually in 2024, which is in favor of the three major businesses increasing their profit margins. In addition, with government policies continuing to bolster consumption for the new energy and automobile industries, and real estate policies bringing positive impacts, the economy enjoying a stronger drive, so, the domestic economic outlook is becoming more optimistic.

Looking ahead at 2024, while policy effects and market sentiment will continue to affect the industry, overseas demand for architectural and automobile glass products has been recovering gradually. Xinyi Glass is building two new production lines in Indonesia, which will start operation in the 2H of 2024. In the future, the Group will continue to strengthen its international development strategy, implement the approach of “Acquiring within the country and building outside the country” (「內購外建」) approach, boosting its overseas sales portfolio and expanding overseas businesses, to further consolidate its leadership and competitive advantages in the industry.

Dr LEE concluded, "Looking back in the past, the Group had been actively responding to various challenges in the market environment, with staff of all levels working as one in pressing ahead amid adversities. At the same time, we seized opportunities to enhance our businesses and raised operational efficiency. Looking ahead, the Group will uphold its spirit of ‘Trust and Passion’, shoulder corporate social responsibility and create greater returns for shareholders."

Photo caption